According to the U.S. Census Bureau, 15.2 million Americans over age fifty-five do not have children. Even those with biological children could end up effectively childless because of the hidden but rather high rate of parental estrangement. (One family in eight admits there is no contact between generations.) And the older we get, the more likely we are to have lost a partner through death or divorce, so even the married may end up aging alone. In a certain way, then, we could all become “solo agers.”

Those without immediate family need to address the assistance usually provided by adult children:

- Social and emotional support. From small but reassuring touch-base texts, to holiday get-togethers, or someone to talk to during a crisis

- Recognition of problems. Noticing when there are medical, cognitive, or functional changes that should be evaluated

- Medical advocacy. Medication management, going to doctors, problem solving, and decision support during Emergency Room visits, hospitalization, or planned procedures

- Going shopping, running errands, attending worship services, social activities

- Housing and care decisions. Help with hiring assistance, choosing a new place to live (retirement community, CCRC, ALF, memory unit), selling the house, downsizing and moving

- Managing finances. Investments, taxes, and support for big financial decisions, as well as more-mundane chores such as bill paying each month and overseeing deposits

- Coordinating care.

- Personal care.

- End-of-life decisions and support.

Like all older adults, solo agers have to prepare financially for their later years and assemble legal documents regarding proxy decision makers. With no known kin, however, the consequences are more dire if they don’t make arrangements ahead of time: They could become wards of the court.

More than their parenting peers, solo agers will need to

- pay for services, locate community programs, or make creative arrangements

- address the realities of social isolation and cultivate new ways to access friends

- be more proactive about their health (physical, emotional, and cognitive) and more vigilant about addressing problems earlier

- accept their need for help despite an independent and self-sufficient mindset

- assemble a team of professionals

As a care manager, these challenges provide opportunities for consultations and services that begin small in the early years but will grow over time and allow you to focus on preventive and quality-of-life activities. What a relief from always putting out fires in the context of crisis management! (More on this later.)

Ideal for networking with referrers

Unlike couples and parents, solo agers tend to be more aware, and aware earlier in their lifespan, of the planning they need to do. Perhaps they cared for their own aging parents and realized they have no one in the next generation to do the same for them.

Unlike couples and parents, solo agers tend to be more aware, and aware earlier in their lifespan, of the planning they need to do. Perhaps they cared for their own aging parents and realized they have no one in the next generation to do the same for them.

Solo agers are a prime audience for your referrers: Attorneys and financial advisors. The earlier the connection, the longer the lifetime revenue for these professionals.

Referrers may not be aware that their clients would benefit from consultations with an Aging Life Care™ Manager. When that information is presented wisely, however, your referrers can immediately see the advantages, for themselves and their clients. For instance:

- Life planning so everyone understands the financial requirements for aging in place. This helps clients and the professional team to create realistic strategies.

- Presenting options and discussing best fit with various care settings. You can suggest cost-effective approaches that will preserve assets (a plus for the client and financial advisors).

- Serving as a guide throughout, helping the solo ager understand the aging process holistically (a boon for attorneys who don’t have the time or training to provide context and support).

- Filling in some of those functions normally handled by adult children.

Position yourself as THE local expert in solo aging.

You not only attract next-generation clients, but you also position yourself as a critical member of your referrers’ support network. Contact us for exclusive resources to help. (None of your competitors can license our materials.) Tasha@elderpagesonline.com

Who are solo agers?

The U.S. Census Bureau reports that one in six adults age fifty-five and older does not have biological children. The younger the person, the greater the likelihood of never having had children. Note the rate of childlessness:

The U.S. Census Bureau reports that one in six adults age fifty-five and older does not have biological children. The younger the person, the greater the likelihood of never having had children. Note the rate of childlessness:

- 19.6% of those age fifty-five to sixty-four

- 15.9% of those age sixty-five to seventy-four

- 10.9% of those age seventy-five or older

A lack of biological children also tends to go with a lack of spouse or significant other.

- Twice as a many childless older adults (40%) live alone compared with their parenting peers (20%).

Even those older adults who have stepchildren or adopted children are much more likely to live alone:

- One in four older adults with biological children lives with a child (biological, adopted, or step).

- One in twenty-five biologically childless older adults lives with a stepchild or adopted child.

While the fully solo ager (no kids, no spouse) may lack social support in the home, if they have been solo for long, they often have stronger support networks outside the household. But these arrangements do not hold up over time as age and disability reduce access to peers and the pool of peers available for socializing or pitching in to help.

Surprising wealth of women

Among solo agers, it is the educated women who will be most receptive to your services. Women tend to be health care decision makers, planners, and caregivers. The need is obvious to them, even in their middle age (fifties and early sixties). Just after their parents die, for instance, awareness will be high. Talk to your referrers about this teachable moment.

Among solo agers, it is the educated women who will be most receptive to your services. Women tend to be health care decision makers, planners, and caregivers. The need is obvious to them, even in their middle age (fifties and early sixties). Just after their parents die, for instance, awareness will be high. Talk to your referrers about this teachable moment.

What may surprise you is that female solo agers are the best positioned to afford your services!

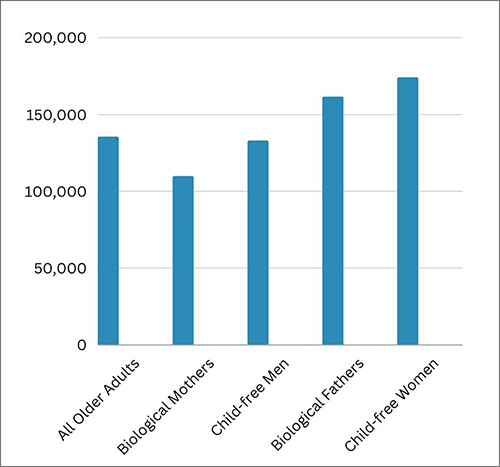

According to the U.S. Census Bureau, the median net worth of child-free older women tops that of their peers.

- Average for all older adults: $135,000

- Biological mothers: $109,500

- Child-free men: $132,500

- Biological fathers: $161,200

- Child-free women: $173,800

This is where the freedom from children allowed for greater attainment of goals, both educational and financial.

Data from the Pew Research Center indicate that 38% of child-free older adults have a bachelor’s degree or more. The percentage of boomer women who earned graduate and professional degrees was much greater among the child-free than among those who were parents. For instance, by the end of their childbearing years (mid-forties), 35% of female MDs and PhDs did not have children, more than twice the percentage of child-free women in the general population at that time.

Liberated from the expenses of raising children and from time taken off work for mothering, it appears child-free women were able to amass assets earlier and benefit from long-term investments.

Male solo agers

It is interesting to note that child-free men have such a significantly lower net worth. They are more likely to have never formed domestic relationships, which seems to be associated with lower self-rated health scores than those of childless women their age. (Researchers have found that self-rated health scores—excellent, good, fair, poor—tend to reflect a pretty accurate picture of morbidity and mortality.)

One could say men are more isolated, in poorer health and presumably in greater need of your care management services. But males who are aging solo may not be as interested nor as able to pay for them. I was not able to find data about the more educated and wealthier solo males. That may be a different story.

Although men more commonly prefer to go it alone, I wouldn’t rule them out entirely. Ask your referrers what they think. You may need to work together to come up with more gender-receptive ways of suggesting your services to men. Perhaps from the financial, life care planning angle. Or focusing on the older male who may be coping with widowhood and was relying on his wife to make and coordinate care decisions.

Services you can offer now

While your older, more functionally challenged care management client may be more immediately lucrative, with higher monthly hours, the solo ager is a strongly proactive planner. This gives you many opportunities starting earlier in the life cycle to provide expertise and create a solid relationship. Not only do you gain a larger lifetime revenue from this next-generation client, but high-touch clients of wealth managers, for instance, are eager to maintain quality of life and are generally very receptive to preventive-care strategies.

While your older, more functionally challenged care management client may be more immediately lucrative, with higher monthly hours, the solo ager is a strongly proactive planner. This gives you many opportunities starting earlier in the life cycle to provide expertise and create a solid relationship. Not only do you gain a larger lifetime revenue from this next-generation client, but high-touch clients of wealth managers, for instance, are eager to maintain quality of life and are generally very receptive to preventive-care strategies.

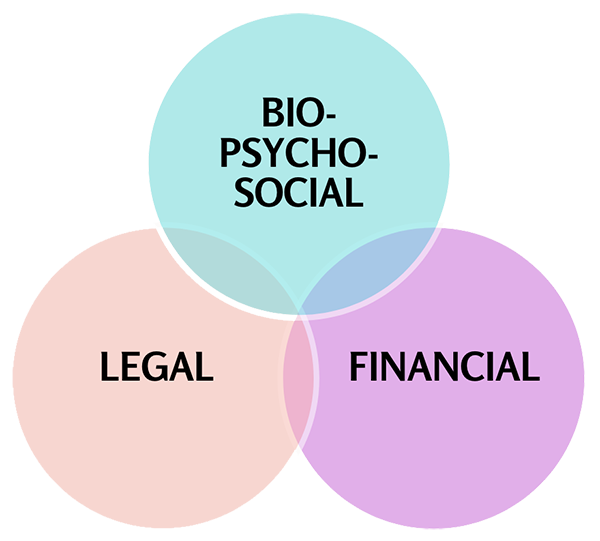

Becoming the local expert in solo aging gives you a powerful pitch to your referrers: They provide the legal and financial expertise. You flesh out the bio-psycho-social side of the picture with services such as the following:

- Aging in place consultations. Offer consultations about the unique issues to address as a solo and what the costs will be to secure the necessary care at home. Emphasize your ability to explore insurance coverage or existing benefit packages that can help with expenses. If you are current on cost-saving technology for independence, promote this as well. (Wealth managers are especially attracted to strategies that maintain the value of the portfolio because they usually get paid a percentage of the assets.)

- Long-term care consultations. The array of options is mind-boggling. People do not generally understand the difference between assisted living, SNFs, memory units, board and care, etc. Outline your ability to offer consults that result in recommendations tailored to the client’s budget and personal priorities. Again, emphasize your ability to help clients take advantage of insurance or benefits packages they may not realize they have coming (e.g., vet benefits, long-term care policy).

- Moving and downsizing support. Sorting through a lifetime of possessions is daunting, emotionally and physically. It helps to have someone who understands and can assist with distribution, packing, moving, and unpacking. Even if you will ultimately refer clients to a senior move manager, it’s still wise for solos to consult with you to get a reality check about staying where they are, downsizing locally, or moving closer to nieces and nephews. You can investigate issues in the new location that they may not have thought about, such as the portability of their Medicare policy and the availability of medical care. You can research the general cost of living for them (food, utilities, recreation) using the CNN Cost of Living Calculator. You can investigate driving alternatives in the new venue at RidesInSight.org and determine the walkability score of their preferred new neighborhood at WalkScore.com. You can also refer them to an Aging Life Care™ Professional in the new location who can continue to help them get settled and find resources.

- On-call medical advocacy. A big concern of solo agers is who will be there for them if they suddenly end up in the ER, especially if they are unconscious or unable to speak. If you live in Florida or another high-retirement location, this is an invaluable service for people who move in and don’t know anyone locally. (This also holds true for snowbirds who do have family “back home” but no one to help locally if they get in trouble.)

- Preplanned surgery coordination. Solo agers may lack a support system to help with a short-term recovery need. Promote your ability to coordinate care and to even save them a stint in rehab. Many surgeries can be done outpatient (e.g., a hip replacement) with home health for their follow-up therapy. Your services ahead of time can save clients discomfort and recovery time afterwards.

- Counseling/coaching about life transitions. Widowhood. Divorce. Estrangement. Health challenges. Memory problems. Financial worries. Friends moving away. Depression and anxiety. You know the list. But your referrers may not know or understand the onslaught of issues that can come up generally and for solos in particular. Educate them about your bio-psycho-social approach and your ability to provide insight and strategies that help clients more positively and confidently cope with the inevitable changes of aging.

- End-of-life care. Very few people have experience with death and dying. And even fewer want to think of it. But you do. And your referrers need to understand the tenderness of those last few weeks and months. Dying is an intensely personal, emotional, spiritual, and physical process and very difficult to do alone. Hospice provides some support, but they have limits. From selection and monitoring of home care assistance to care coordination, finding a home for a beloved pet, or just the solace of someone who understands the immensity of the journey, you can provide comfort and support during this tender yet profound life passage.

Want to become THE local expert in solo aging?

We have services to help you promote this aspect of your practice:

- A solo aging presentation (for solo agers and for referrers)

- A branded solo aging handout

- Facebook and LinkedIn posts to assist with your promotions

- A template for a letter to attorneys

- A template for a letter to financial advisors

- A monthly Aging Well Blog addressing issues of the young-old (the “proactive planners,” including but not limited to solo agers)

- A monthly branded handout corresponding to each blog that you can print or send by email to proactive planners and to your referrers. Think of it as a one-article monthly e-newsletter.